What is GST ?

Introduced in India since July 2017 in GST registration. In accordance with the Act it is a combination of an indirect tax such as VAT & Service Tax.

You are required to exceed 40 lakh rupees per year (10 Lakh for NE * Hill States) by your sales or sales, in accordance with the latest amendment from 1 April 2019.

For some particular companies, without crossing the sales limit, registration is mandatory. For example, you need to register the GST from the start of your business if you are running an e-commerce enterprise. Online GST Registration is only 2-3 business days in length and we have a verified GST Certification in your email address with login details.

What are the benefits of the GST Registration ?

Take input tax credit – GST Input tax credit may be used by GST Registrants when buying goods and services. So if you are a B2B company then you need GST from the beginning.

Stronger than the Company – GST Registration provides you with valid legal entity registrations so that any other company or individual can easily show your valid proof.

Open your current account – on the basis of GST R, GSTIN Holder can easily open your current bank account

Online selling — you can easily sell with E-Commerce portals such as Amazon or Flipkart, etc, using the GSTIN Registration Number —

Govt projects tender: all of the government projects only require valid firms with the GST number if you are a contractor and wish to tender for any type of govt tender.

Accept large MNC projects – Until you have a valid legal entity evidence business, MNC does not deal with the same thing. MNC does not.

Enhance confidence between your customers – If you issue a valid GSTIN Tax Invoice, the trust between your customer increases and your brand value increases

Our Team TaxnLoan Solution will help on every step in GST Registration.

a) In the case of Sole Proprietorship Firm –

Pan Card and Address Proof of the proprietor.

Electricity bill of Business Place.

Phot of Proprietor

Name of Firm

Activity type in Business

b) In case of Partnership Firm –

Pan card of the Partnership Firm

Partner Ship Deed

Electricity bill of Business Place.

Phot of Partners

Pan n Aadhar Card of Partners

Activity type in Business

c) In the case of Private Limited Company or One Person Company –

Pan Card of the Company , COI , MOA & AOA of Company

Company Register Certificate.

Pan and Aadhar card of Director

Phot of director

Electricity bill of business Place

Who is eligible to register under GST ?

GST Registration should be finished by the accompanying people and organizations:

People who have enrolled under the assessment administrations under the watchful eye of the GST law became effective.

Non-Resident Taxable Person and Casual Taxable Person

People who pay charge under the opposite charge instrument

All web based business aggregators.

Organizations that have a turnover that surpasses Rs.40 lakh. On account of Uttarakhand, Himachal Pradesh, Jammu and Kashmir, and North-Eastern states, the turnover of the business ought to surpass Rs.20 lakh.

People who supply products through an internet business aggregator.

People giving data set admittance and online data from outside India to individuals who live in India other than the individuals who are enlisted available people.

FAQ on Registration of GST.

What is the Full Form of GSTIN Number.

GSTIN is referring to Goods and service tax identification number which we already discussed above the 15 digit GSTIN Number.

When GST Registration is required mandatory

What is Address Prof Require for the GST Registration

Does need of gst certificate in import export goods

How many times takes for the GST Registration

There is any rejection during the GST Registration.

How to Choose HSN or SAC Code during GST Registration.

Do I have to visit the GST Department with my paper for any verification

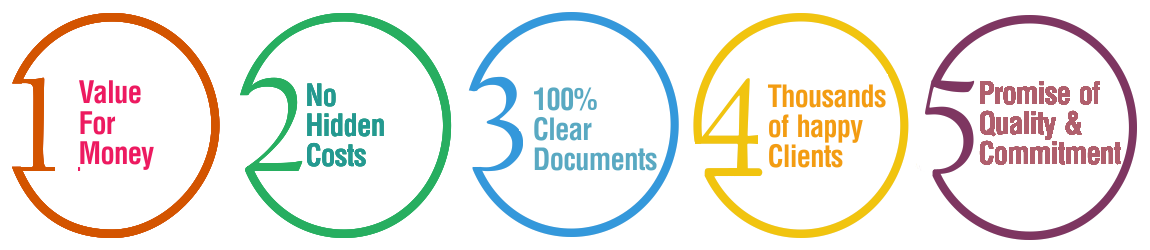

WHY CHOOSE US ?

Kommentarer